FAQs

A Special Economic Zone (SEZ) is a designated area within a country that offers a unique set of economic incentives and regulations, different from the rest of the country, to attract foreign and domestic investment.

The Special Economic Zones Authority (SEZA) provides 3 types of licenses to facilitate different activities within SEZs.

- The Developer License: Issued to corporate entities engaged in the development of integrated infrastructure facilities within a gazetted SEZ.

- The Operator License: Issued to corporate entities responsible for managing a special economic zone.

- The Enterprise License is issued to corporate entities carrying out business within a Special Economic Zone (SEZ).

SEZ licensed developers, operators and enterprises. The SEZ Authority appraises entities that apply for a developer and/or operator or enterprise license and furnishes them with their respective license.

- A SEZ Developer is an appraised and licensed corporate body responsible for developing an SEZ by ensuring that horizontal, vertical and utility infrastructure is set up. A SEZ developer may choose to operate a SEZ or outsource an entity responsible for operating the SEZ.

- A SEZ Operator is an appraised and licensed corporate body responsible for managing a SEZ.

- A SEZ Enterprise is an appraised and licensed corporate body responsible for undertaking SEZ business activities (as per the granted SEZ license) within a gazetted SEZ.

The SEZ Authority is responsible for recommending sites for designation as a SEZ, appraising applications and granting licenses. Please find guidelines on applying for a SEZ developer license here, operator license here or enterprise license here

Have an E-Citizen account then fill and submit the Developer/Operator Application form and attach necessary documents

- Company Registration: The applicant must be a company registered under the Companies Act (Cap. 486) of Kenya.

- Minimum Capital: The applicant must have a minimum capital of KES 500 million (Section 28(2)).

- Business Plan: The applicant must submit a business plan that outlines the proposed project, including the location, scope, and timeline (Section 28(3)).

- Technical and Financial Capacity: The applicant must demonstrate technical and financial capacity to undertake the proposed project (Section 28(4)).

- Compliance with Laws and Regulations: The applicant must demonstrate compliance with all relevant laws and regulations, including tax laws and environmental regulations (Section 28(5)).

Corporate entities wishing to acquire a SEZ developer license or SEZ operator license must pay USD $5,000 annual license fee. While a corporate entity wishing to acquire a SEZ enterprise license must pay USD $1,000 annual license fee.

SEZ licenses remain valid up to an year where they will require renewal and pay of the respective fee.

For as long as the entity is in ownership of a valid SEZ license.

Kindly check the operating Private SEZs and Public SEZs

This is a certification provided by the SEZ Authority to corporate entities to undertake business not aligned to SEZ core economic activities, however support clustering and core SEZ investments within the zone. SEZ business service permit holders are not permitted to enjoy fiscal incentives provided within the SEZ Act.

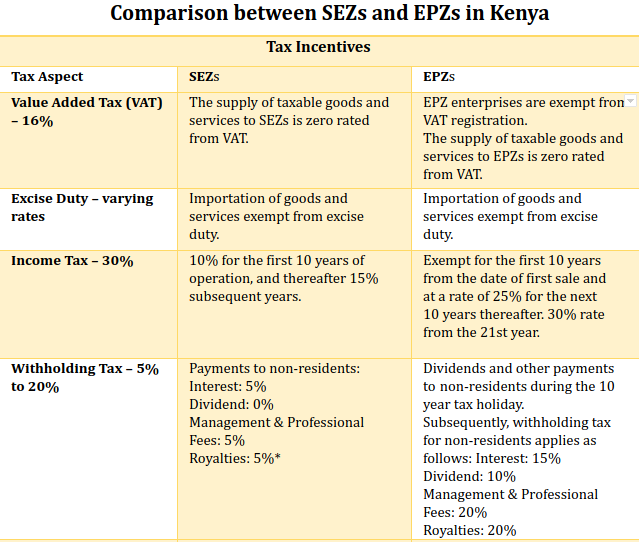

Licensed SEZ entities are entitled to non-fiscal and fiscal incentives as per the SEZ Act and respective domestic tax laws. This is inclusive of fees levied by county government finance acts. Find more on SEZ incentives here: administrative incentives and tax incentives

Each programme has separate policy and legal frameworks governed by separate State Agencies and Regulations. Please find more information on the differences of each programme here.

This is a list of activities not allowed to be undertaken by SEZ enterprises.

This is a facility provided in SEZs where investors can receive facilitation related to SEZ processes in order to remove any bottle necks that may be faced.

Guided by the rationality of an investor, multiple purpose SEZs are encouraged to include the following SEZ sectors during master planning: Free Trade Zones; Industrial parks; Free ports; Information communication technology parks; science and technology parks; agricultural zones; tourist and recreational zones; business service parks; livestock zones; convention and conference facilities. Find more on scope of investments within SEZs here: Investment Schemes

SEZ clusters provide spill over effects in business linkages, knowledge transfer and technology transfer of which SMEs stand to benefit from. SEZs also offer business service parks which facilitate business process outsourcing and other related activities such as consultancy and advisory services, shared service centres and call centres.

A SEZ is a designated and declared area, gazetted for the purpose of undertaking SEZ activities. A SEZ can be categorized as a single sector or multi sector SEZ a number of the SEZ sectors provided in the SEZ Act.

SEZA follow sustom guidelines in accordance to the East African Community Customs Management Act (EACCMA). please be advised that all SEZ goods destined for the East African Market attract import duty as per the EAC Common External Tariff (CET) hand book.

A licensed SEZ entity can import and export goods and services without any set limitations to the number or monetary value of goods.

The Special Economic Zones Authority does not allow SEZ entities to own movable assets outside the custom controlled area as there is a risk of such assets enjoying fiscal incentives outside the SEZ. SEZ entities are prompted to demonstrate exclusivity of use of a movable asset only within a SEZ.

All investors in SEZ will be treated same and this is done to promote consistency and a level playing ground for both Domestic and Foreign Direct Investor